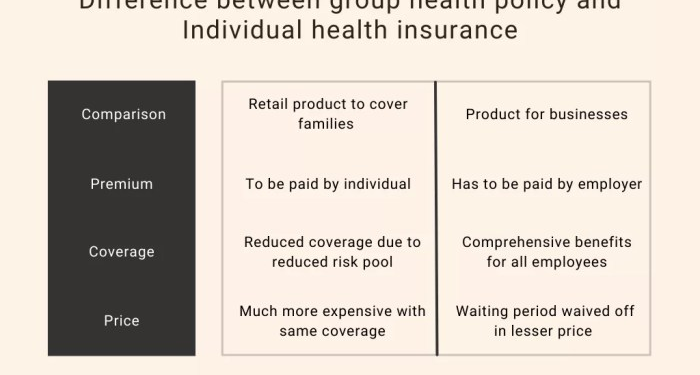

Exploring the differences between Small Business Health Insurance Group and Individual Plans, this article offers insights into the various aspects that businesses need to consider when choosing the right plan for their employees. From understanding the advantages and disadvantages to analyzing the coverage and benefits, this discussion aims to provide a comprehensive overview of the topic.

As we delve deeper into the comparison between group and individual health insurance plans, it becomes evident that there are key factors that play a crucial role in decision-making for small businesses.

Small Business Health Insurance Group vs Individual Plans

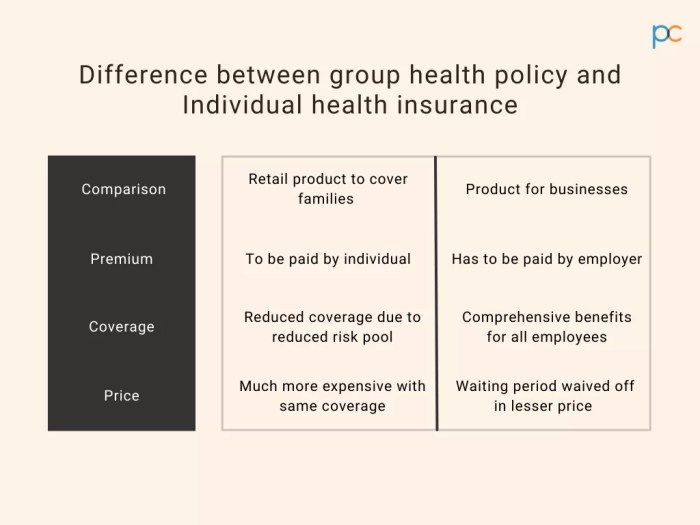

When it comes to health insurance, small businesses and individuals have different options to choose from. Group health insurance plans are typically offered by employers to their employees, while individual health insurance plans are purchased directly by individuals from insurance companies.

Group Health Insurance Plans

Group health insurance plans are commonly provided by employers as part of their employee benefits package. Companies like Aetna, UnitedHealthcare, and Cigna offer group health insurance plans to businesses for their employees. These plans usually have lower premiums compared to individual plans because the risk is spread across a group of people.

- Advantages:

- Lower premiums

- Broader coverage options

- No medical underwriting

- Disadvantages:

- Limited customization

- Lack of portability if you switch jobs

- Less control over plan selection

Individual Health Insurance Plans

Individual health insurance plans are purchased directly by individuals from insurance companies like Blue Cross Blue Shield, Kaiser Permanente, and Humana. These plans offer more flexibility in terms of coverage options and can be tailored to meet individual needs.

- Advantages:

- Customizable coverage

- Portability if you switch jobs

- More control over plan selection

- Disadvantages:

- Higher premiums

- Medical underwriting may be required

- Limited network options

Factors to Consider when Choosing Between Group and Individual Plans

When small businesses are deciding between group and individual health insurance plans, there are several key factors to consider to make the best choice for their employees and business needs.

Business Size Impact

The size of the business plays a significant role in determining whether to opt for a group or individual health insurance plan. Larger businesses with more employees may benefit from group plans as they can often negotiate better rates and offer more comprehensive coverage.

On the other hand, smaller businesses may find individual plans more cost-effective and easier to manage due to lower administrative requirements.

Cost Implications

Choosing between a group and individual health insurance plan can have different cost implications for a small business. Group plans typically have lower premiums per employee compared to individual plans, making them a more affordable option for businesses with multiple employees.

However, individual plans may offer more flexibility in terms of coverage options, allowing employees to tailor their plans to their specific needs, which could result in higher overall costs for the business.

Coverage and Benefits

When comparing group health insurance plans to individual health insurance plans, it is important to understand the differences in coverage and benefits offered by each.

Coverage and Benefits of Group Health Insurance Plans

Group health insurance plans typically offer comprehensive coverage to all employees within a company. This coverage often includes medical services, hospitalization, prescription drugs, preventive care, and mental health services. Group plans also tend to have lower premiums compared to individual plans, as the risk is spread across a larger pool of individuals.

Coverage and Benefits of Individual Health Insurance Plans

Individual health insurance plans, on the other hand, are tailored to the specific needs of one person or family. While these plans may offer flexibility in choosing coverage options, they often come with higher premiums due to the individualized nature of the plan.

Coverage under individual plans may vary depending on the specific policy chosen, and individuals may have to pay more out-of-pocket for certain services.

Real-life Examples of Coverage Variation

For example, a group health insurance plan offered by a large corporation may include coverage for vision and dental care as part of the standard benefits package. In contrast, an individual health insurance plan purchased through a marketplace may require additional premiums for the same vision and dental coverage.

This demonstrates how the coverage and benefits of group plans can often be more comprehensive and cost-effective compared to individual plans.

Customization and Flexibility

When it comes to small business health insurance, customization and flexibility are key factors that can greatly impact the overall satisfaction of employees and the effectiveness of the plan. Group health insurance plans offer a certain level of customization and flexibility that can be tailored to meet the specific needs of a small business and its employees.

Let's delve deeper into how small businesses can make the most of this feature.

Tailoring Group Health Insurance Plans

- One way small businesses can customize their group health insurance plans is by choosing the specific coverage options that best suit their employees' needs. This could include options for dental, vision, mental health, or maternity care.

- Another way to tailor group health insurance plans is by offering different plan options to employees based on their individual needs. For example, some employees may prefer a lower premium with higher out-of-pocket costs, while others may prefer a higher premium with lower out-of-pocket costs.

- Small businesses can also customize their group health insurance plans by adding wellness programs or incentives to promote healthy living among employees. This can help reduce overall healthcare costs and improve employee well-being.

Successful Examples

- A small tech startup decided to offer a group health insurance plan that included coverage for mental health services, as they recognized the importance of mental well-being in their high-stress industry. This customization helped improve employee morale and productivity.

- A family-owned restaurant chain customized their group health insurance plan by offering different plan options to accommodate their diverse workforce. This flexibility allowed employees to choose a plan that best fit their individual healthcare needs and preferences.

Last Word

In conclusion, the choice between Small Business Health Insurance Group and Individual Plans is not a one-size-fits-all decision. By weighing the pros and cons, considering the specific needs of the business, and evaluating the cost implications, businesses can make an informed choice that aligns with their goals and priorities.

FAQ Insights

What is the main difference between group health insurance plans and individual health insurance plans?

The main difference lies in who purchases the insurance and who it covers. Group plans are purchased by employers to cover a group of employees, while individual plans are bought by individuals to cover themselves and their families.

How does the size of the business impact the choice between group and individual health insurance plans?

The size of the business can impact factors like cost, coverage options, and administrative requirements. Larger businesses may have more bargaining power and resources to offer better group plans, while smaller businesses may find individual plans more cost-effective.

What are some examples of companies that offer group health insurance plans?

Some examples include large corporations like Google, Microsoft, and Walmart, as well as smaller businesses that pool resources to provide group coverage for their employees.